Ky Homestead Exemption 2025 Deadline - During his state of the state address kicking off the start of the 2025 legislative session on jan. Under the kentucky constitution, property owners who are 65 or older are eligible to receive the homestead exemption on their primary residence. April 1 is the Homestead Exemption Application Deadline for Fulton, — the kentucky department of revenue has set the maximum homestead exemption at $46,350 for the 2025 and 2025 tax periods. The kentucky department of revenue has set the maximum homestead exemption at $46,350 for the 2025 and 2025 tax periods.

During his state of the state address kicking off the start of the 2025 legislative session on jan. Under the kentucky constitution, property owners who are 65 or older are eligible to receive the homestead exemption on their primary residence.

This means that $40,500 of your home’s value is exempt from property taxes.

The kentucky department of revenue has set the maximum homestead exemption at $46,350 for the 2025 and 2025 tax periods.

What is Homestead Exemption and when is the deadline? — Gailey, In 2025, several states, including texas, indiana and kentucky, enacted changes to their homestead tax exemption regulations. In kentucky, homeowners who are least 65 years of age or who have been classified as totally disabled and meet other requirements are eligible to receive a homestead.

Homestead related tax exemptions Fill out & sign online DocHub, The exemption amount for the past several years is as. Under the kentucky constitution, property owners who are 65 or older are eligible to receive the homestead exemption on their primary residence.

Ky Homestead Exemption 2025 Deadline. The kentucky department of revenue has set the maximum homestead exemption at $46,350 for the 2025 and 2025 tax periods. — the kentucky department of revenue has set the maximum homestead exemption at $46,350 for the 2025 and 2025 tax periods.

During his state of the state address kicking off the start of the 2025 legislative session on jan.

In kentucky, homeowners who are least 65 years of age or who have been classified as totally disabled and meet other requirements are eligible to receive a homestead.

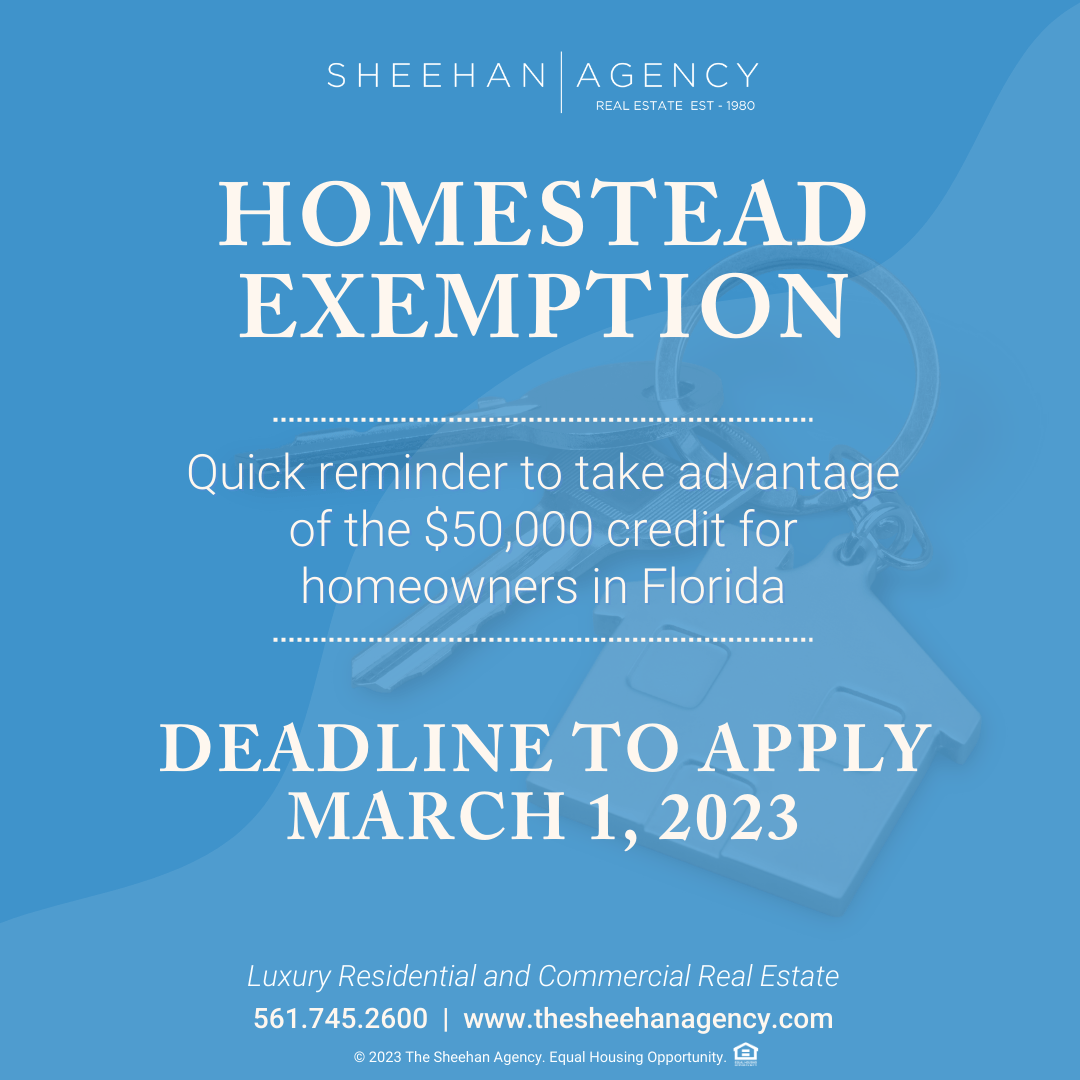

Homestead Exemption Deadline is March 1, The kentucky department of revenue has set the maximum homestead exemption at $46,350 for the 2025 and 2025 tax periods. Under the kentucky constitution, property owners who are 65 or older are eligible to receive the homestead exemption on their primary residence.

Propose to amend section 170 of the constitution of kentucky to include in the homestead exemption for owners who are 65 years of age or older any.

Homestead Exemption Form, Don't to File in 2021! Christy Buck Team, 10, justice proposed three tax cuts that would return $49.7 million to. November 24, 2022 zac oakes wjrs news.

Homestead Exemptions By State With Charts Is Your Most Valuable Asset, In kentucky, homeowners who are least 65 years of age or who have been classified as totally disabled and meet other requirements are eligible to receive a homestead. During his state of the state address kicking off the start of the 2025 legislative session on jan.

THE HOMESTEAD EXEMPTION DEADLINE IS MARCH 1st The Sheehan Agency, The kentucky department of revenue has set the maximum homestead exemption at $46,350 for the 2025 and 2025 tax periods. In kentucky, homeowners who are least 65 years of age or who have been classified as totally disabled and meet other requirements are eligible to receive a homestead.

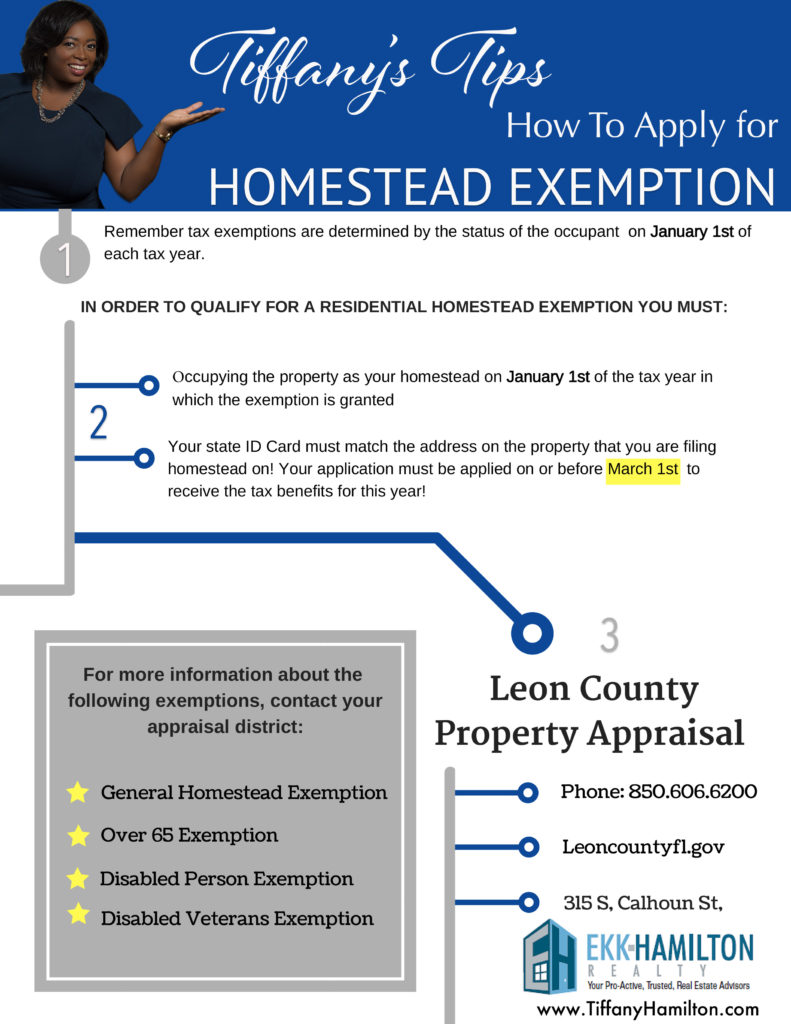

Homestead Extension Deadline Hamilton Realty Advisors, Once the property tax rate is. (november 23, 2020) the kentucky department of revenue (dor) has set the maximum homestead exemption.

HOMESTEAD EXEMPTION DEADLINE JUNE 30, 2022 Cuming County Government, In kentucky, homeowners who are least 65 years of age or who have been classified as totally disabled and meet other requirements are eligible to receive a homestead. By statute, the amount of the homestead exemption is recalculated every two years to.

What Is a Homestead Exemption and How Does It Work? LendingTree (2022), This adjustment is made by the office of property valuation in every odd numbered assessment year. 10, justice proposed three tax cuts that would return $49.7 million to.